You’re a small carrier. Margins are very slim for you. You pay for your equipment, insurance, fuel, IFTA taxes, tolls, repairs, and in some cases your driver’s salary. Anything that can go wrong with a load is typically your fault as the brokers are quick to shift the blame to you and your MC number. But what happens when the brokers are the bad guys?

Since the Covid Pandemic in 2020, we’ve all heard about the elevated fraud in the trucking industry. The most common type of fraud has been labeled Double Brokering, which is a practice where a carrier accepts a shipment from a broker and then subsequently tenders the same shipment to another carrier for transport. This means the carrier is essentially acting as a middleman and profiting off the work of another carrier, without doing any of the actual transportation. This practice is fraud because the carrier is misrepresenting itself as the actual carrier of the goods, when in reality they are acting as a broker. While this practice is now heavily scrutinized, with various verification methods in place, there is another type of fraud that is rarely mentioned but is costing carriers their livelihood....Fake Broker Fraud.

The Con

Fake Brokers are fly-by-night operations. In most cases they are fake businesses that have real credentials. Brokers only need a $75,000 bond to operate in the U.S. under the Federal Motor Carrier Safety Administration (FMCSA). A broker’s bond is supposed to give accountability to the shippers and carriers, but an administrative judge ruled in 2019 that the regulator (FMCSA), an agency in the Transportation Department, didn’t have the authority to assess civil penalties for unauthorized brokerage. Since then, the agency has encouraged carriers and shippers to check the FMCSA licensing status of companies they wish to work with…And this is where the problem lies.

A Fake Broker will name their brokerage similar to a legitimate brokerage, mainly only changing subtle differences in the name. This is meant to confuse a shipper into awarding a load to the Fake Brokerage. Often it's smaller shippers that don’t ship regularly who are deceived into awarding the Fake Broker with a load. The Fake Broker then posts their real load on the loadboard, waiting for an unsuspecting carrier to book the load. The gullible carrier is then fooled into thinking it's a legitimate load because they have heard of the brokerage before, only because the name looks and sounds indistinguishable to a legitimate brokerage. The hoodwinked carrier completes a setup package that appears to be a real transaction, however the Fake Brokerage has no intent on paying the carrier for their services once the load is delivered. The swindled carrier will send in the Bill of Lading and attempt to collect from the broker, but no one answers the phone and no one replies to the emails. The Fake Broker will receive their payment from the shipper and disappear.

How to avoid being bamboozled

1. Check the broker's credit with multiple factoring companies. If a Fake Broker hasn’t been paying people, the factoring companies will know about it. Fake brokerages can only operate for a few weeks. Because of this, it is a good idea to check the brokerage across different factoring companies as some will not have caught the non-payment scheme right away. If a broker is approved with one factoring company, but not in another - this should be a red flag.

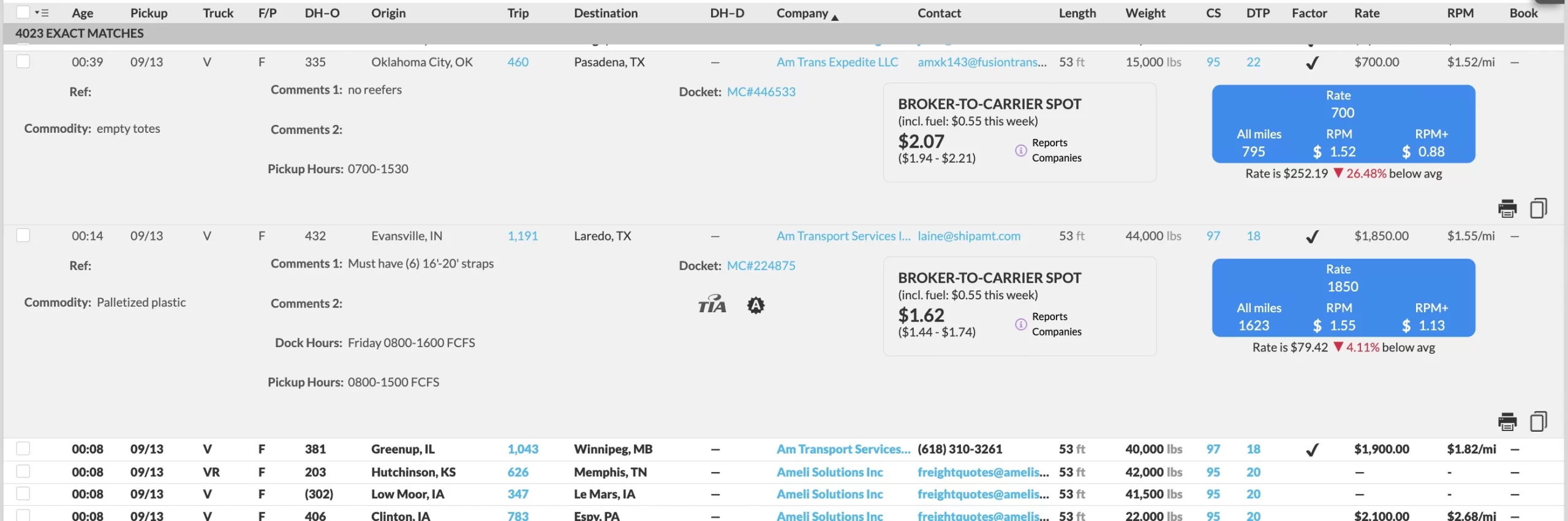

2. Look closely at the load posting on the loadboard. Avoid postings with the words like “Quick Pay Available,” “Cash on Delivery,” and “Can pay with ComCheck or EFS check.”

3. Compare the rate to similar postings of the same lane. If the rate is too good to be true, it usually is. A huge rate compared to other similar loads will lure carriers in the quickest - red flag.

4. Pay attention to the email URL and phone number. If the email URL is too dissimilar from the broker’s name and looks like a personal email, this will be your red flag. Also if the broker’s business is listed in a city that doesn’t match the area code of the number in the load posting, this is your sign the load could be no good.

Not getting paid from a broker can put most small carriers in jeopardy of losing their business. The fraudsters tend to appear in the marketplace when the rates are down. And because carriers are desperate for better pay, people don’t do their normal vetting of information. While there is no guarantee these steps can avoid spotting a fraudulent broker, staying aware and vigilant can help you steer clear of the back actors in our industry.